Form 941 Due Date 2025. Employers must ensure that they submit form 941 by these deadlines. By the normal rules, assuming you made timely payments of the taxes, your erc claim would be due very.

Due to rising inflation, many taxpayers and financial experts expect an increase. For example, the statute of limitations for all four forms 941 filed for 2020 generally would expire on april 15, 2025, and the statute of limitations for all four forms.

For All Quarters In 2020, The Deadline To Apply For The Erc Is April 15, 2025, And For All Quarters In 2021, The Deadline Is April 15, 2025.

Quarterly federal tax form 941 for the third quarter ending september 30, 2025.

Employers Must Ensure That They Submit Form 941 By These Deadlines.

View due dates and actions for each month.

Form 941 Due Date 2025 Images References :

Source: www.aggregate941filing.com

Source: www.aggregate941filing.com

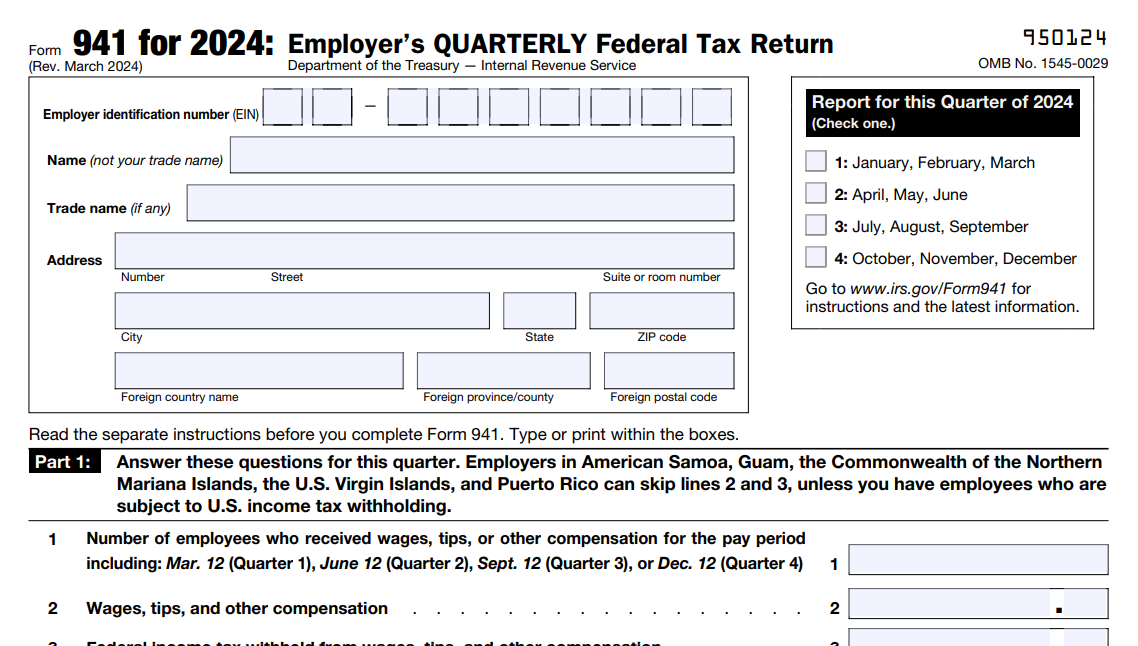

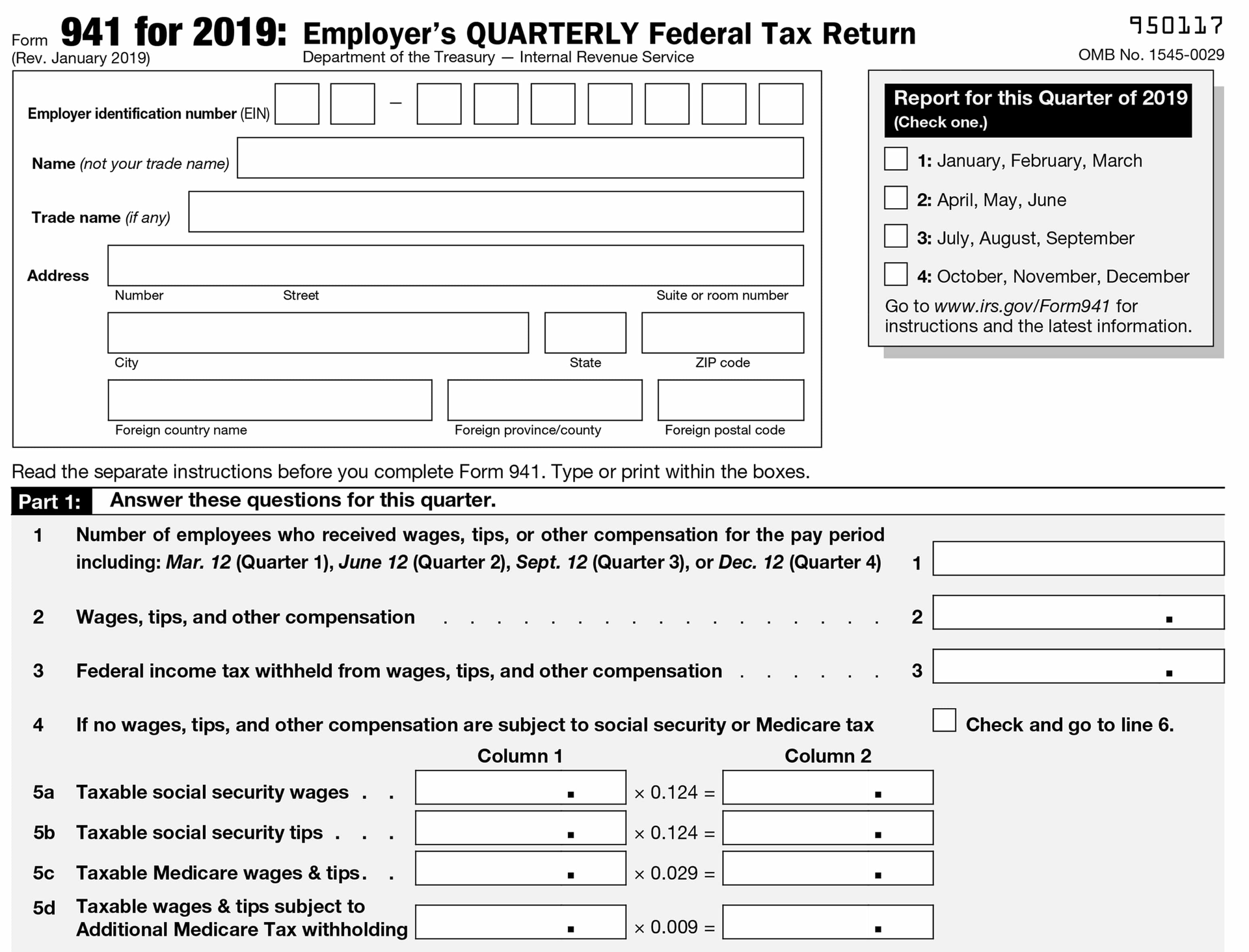

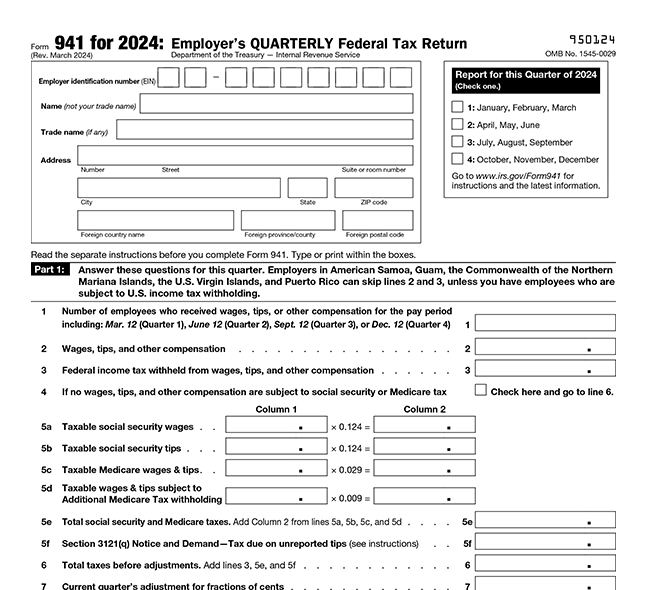

Aggregate Form 941 Filing Software EFile 941 Schedule R, For all quarters in 2020, the deadline to apply for the erc is april 15, 2025, and for all quarters in 2021, the deadline is april 15, 2025. Employers must file irs form 941, employer's quarterly federal tax return, to report the federal income taxes withheld from employees, and employers' part of social security.

Source: www.patriotsoftware.com

Source: www.patriotsoftware.com

What Is Form 941? Reporting Employee Wages and Taxes, View due dates and actions for each month. For example, the statute of limitations for all four forms 941 filed for 2020 generally would expire on april 15, 2025, and the statute of limitations for all four forms.

Source: blog.123paystubs.com

Source: blog.123paystubs.com

Form 941 is Due TODAY! 123PayStubs Blog, Key takeaways for the employee retention tax credit deadlines in 2023, 2025, 2025. Employers must file irs form 941, employer's quarterly federal tax return, to report the federal income taxes withheld from employees, and employers' part of social security.

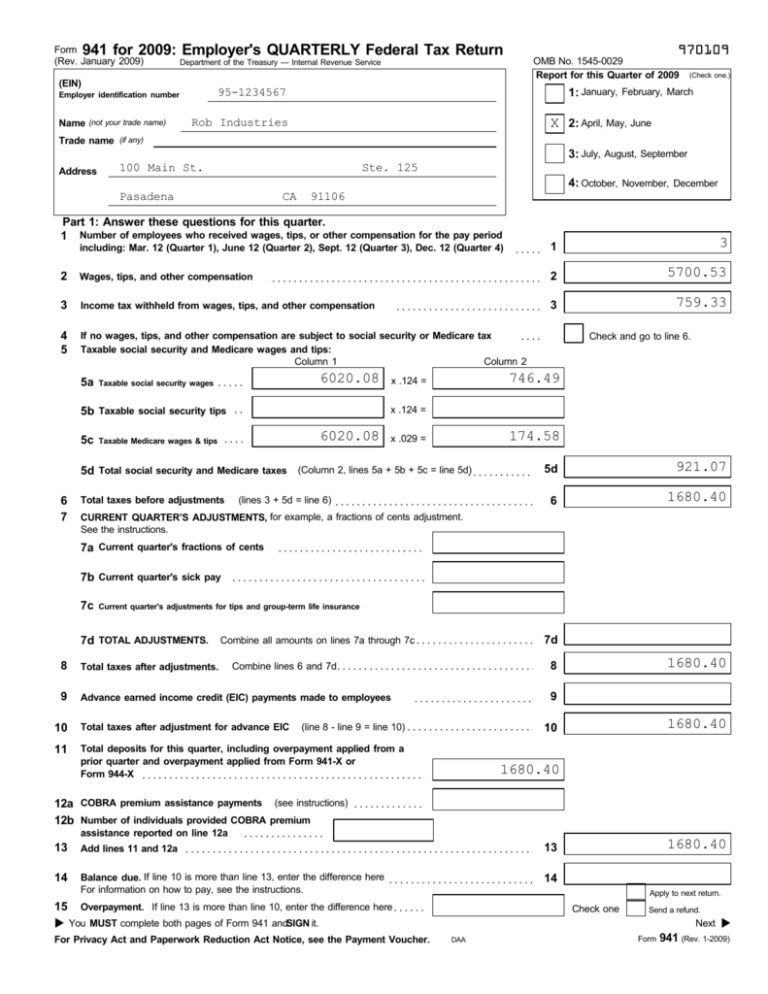

Source: studylib.net

Source: studylib.net

941 Federal Form RABco Payroll Service, Here are the due dates for each quarter: You’ll report withholding amounts for federal income taxes and.

Source: www.expressefile.com

Source: www.expressefile.com

IRS Form 941 Online Filing for 2023 EFile 941 for 4.95/form, The employee retention credit (erc) is a refundable tax credit for eligible employers that paid qualified wages after march 12, 2020, and before october 1, 2021.1 while the erc program expired in 2021, eligible employers can still claim the erc for. Key takeaways for the employee retention tax credit deadlines in 2023, 2025, 2025.

Source: www.marathonhr.com

Source: www.marathonhr.com

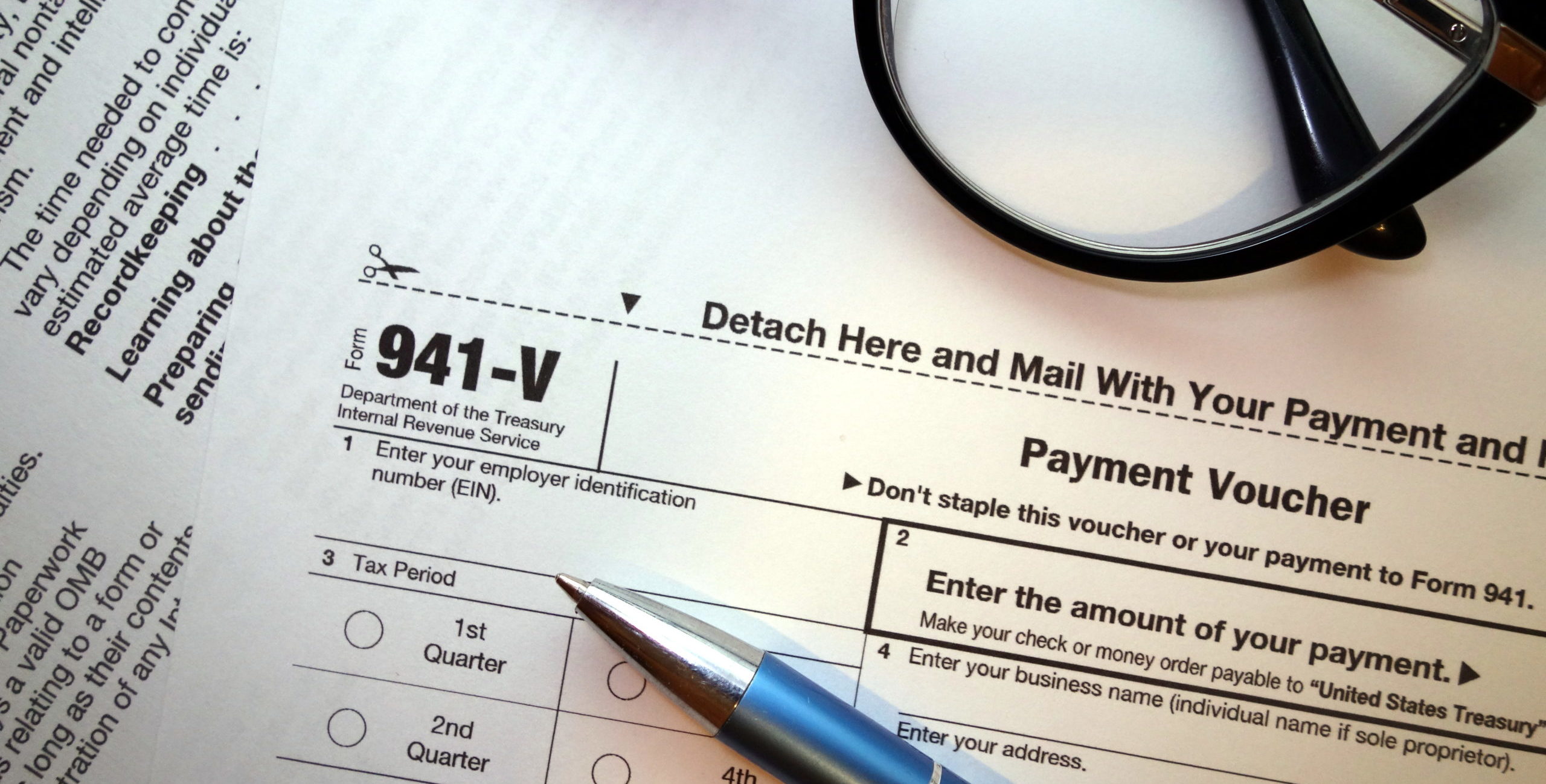

Visible Changes in Form 941 due to CARES, FFCRA and EFMLA MarathonHR, LLC, The final dates for eligible businesses to claim the ertc is with their quarterly form 941 tax filings, due july 31, oct. Form 941 is filed quarterly.

Source: www.youtube.com

Source: www.youtube.com

How To File Form 941 for 3rd Quarter With TaxBandits YouTube, The current limit of rs. You can see all events or filter them by monthly depositor, semiweekly depositor, excise, or general event types.

Source: www.bench.co

Source: www.bench.co

Form 941 Instructions & How to File it, Know the form 941 due dates for each quarter of 2025. The original return (form 941) was due july 31, 2020.

Source: www.cpapracticeadvisor.com

Source: www.cpapracticeadvisor.com

What is a Payroll Lookback Period for Forms 941 and 944 CPA Practice, Quarterly estimated taxes are due by jan. If any due date for filing.

Source: www.taxzerone.com

Source: www.taxzerone.com

Effortless Employment Tax Filing Form 941 Made Simple, Quarterly federal tax form 941 for the third quarter ending september 30, 2025. When is form 941 due?

1.5 Lakh Has Remained Unchanged Since 2014.

The due dates typically fall on the last day of the month following the end of the quarter, giving employers one month to prepare the form.

By The Normal Rules, Assuming You Made Timely Payments Of The Taxes, Your Erc Claim Would Be Due Very.

You can see all events or filter them by monthly depositor, semiweekly depositor, excise, or general event types.

Posted in 2025